How collateral ratio requirements are used in Nerite

MCR (Minimum Collateral Ratio):

- This is the minimum collateral ratio required for individual troves

- If a trove's ICR (Individual Collateral Ratio) falls below MCR, it becomes eligible for liquidation

- Acts as a safety threshold for individual positions

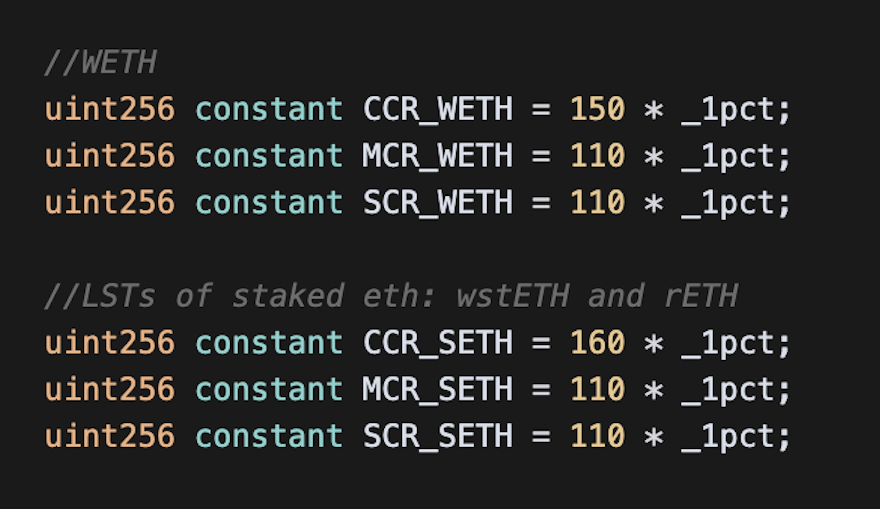

- From the constants set in our code, we can see MCR values:

WETH: 110% (110e16)

LSTs (wstETH/rETH): 110% (110e16)

Tokenized Bitcoin (tBTC): 115%

Other collaterals have more strict requirements based on risk analysis.

CCR (Critical Collateral Ratio):

- This is the branch-wide critical threshold that affects borrowing operations

- When the branch's TCR (Total Collateral Ratio) falls below CCR:

- New borrowing is restricted unless it brings TCR back above CCR

- Collateral withdrawals are only allowed if accompanied by debt repayment of equal value

- Troves can't be adjusted in ways that would reduce the TCR

- Higher than MCR to provide a buffer before liquidation

- From the code, we can see CCR values:

WETH: 150% (150e16)

LSTs (wstETH/rETH): 160% (160e16)

SCR (Shutdown Collateral Ratio):

- This is the branch-wide shutdown threshold

- If the branch's TCR falls below SCR:

- The protocol triggers a shutdown of the borrow market

- All borrowing operations are permanently disabled

- Only closing troves is allowed

- Acts as a last-resort safety mechanism

- From the code, we can see SCR values:

WETH: 110% (110e16)

LSTs (wstETH/rETH): 110% (110e16)

BCR (Batch Collateral Ratio)

There is also BCR, which is an additional ratio that must be used when doing operations on batches of troves at once. Batched troves must maintain ICR ≥ MCR + BCR.

The relationship between these ratios can be seen in the code, particularly in the BorrowerOperations contract. Check out Constants.sol to see all the deployment settings for each collateral used in Nerite.